After a number of days of an announcement being anticipated, yesterday evening the Chancellor announced new measures to support self-employed workers through the COVID-19 pandemic.

Those that are self-employed will now receive a taxable grant worth up to 80% of their average monthly trading profits over the past three years. The self-employment Income Support Scheme will be in place for a period of three months, but the Chancellor said this would be extended if required.

The depth and breadth of the impact this pandemic is having on the economy means it might well be the case that time-limited measures last for longer than first planned – particularly as it is becoming increasingly clear that the effects of this pandemic will last much longer than the few weeks or months first though.

Who is eligible for the scheme?

The support will be available for self-employed people who:

- submitted a Self Assessment tax return of 2018/19;

- traded in the 2018/19 tax year;

- are trading – or otherwise would be were it not for COVID-19 – when they apply;

- intend on continuing to trade when in the 2020/21 tax year;

- have lost trading profits as a result of COVID-19;

- have trading profits less than £50,000 and more than 50% of their income from self-employment.

The last criterion can be met either on average over the past three years or over 2018/19 alone.

The scheme does not cover those self-employed who are incorporated and pay themselves via dividends. However, if they also pay themselves earnings via the PAYE system, it appears they can receive support through the Employee Retention Scheme. The £50,000 cap means that high earners are excluded, and because you need to have filed a 2018/19 tax return to qualify, those that have become self-employed only very recently are also excluded.

There is also a cliff-edge in the policy: whilst someone reporting £49,999 profit in a trading year will receive the full support of the scheme, an individual making £50,001, in theory, will be eligible for nothing.

We do not have data readily available with which to estimate the number of people that will miss out on support. It appears, however, that the government designed the policy with those they deem most likely to fall into extreme hardship in mind – hairdressers, taxi drivers, skilled tradespeople among them.

Self-employment in Scotland

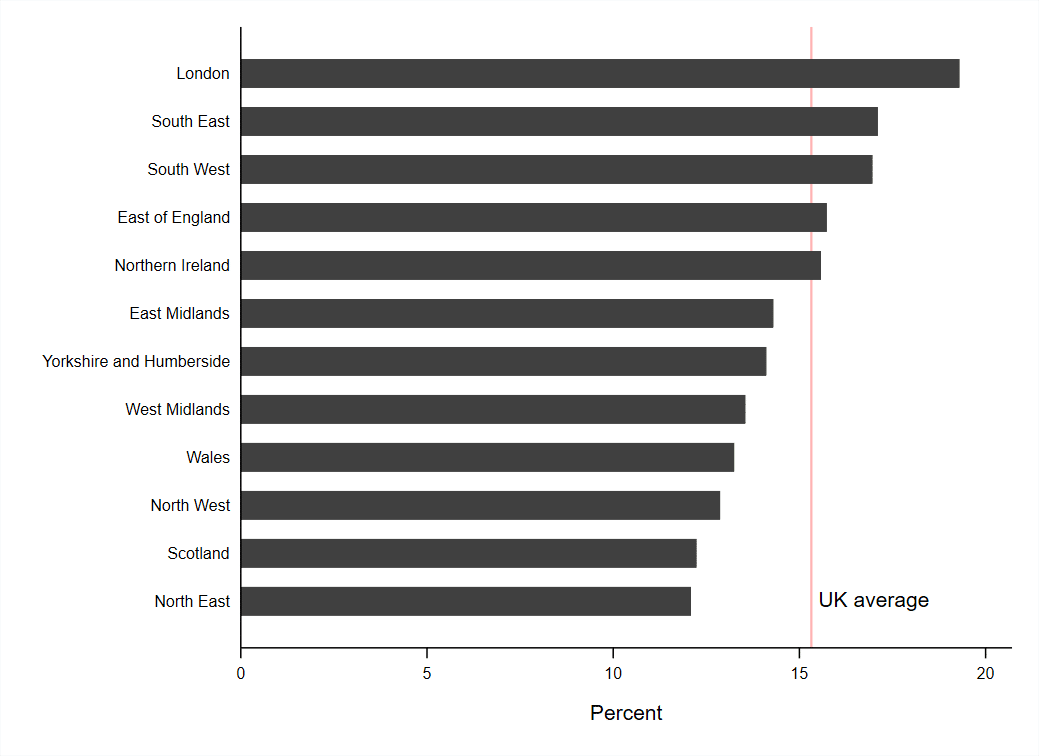

Scotland does have one of the lowest rates of self-employment in the country, however, excluding London, the differences across parts of the UK are relatively low (Figure 1).

Figure 1: Proportion of workers self-employed by UK region

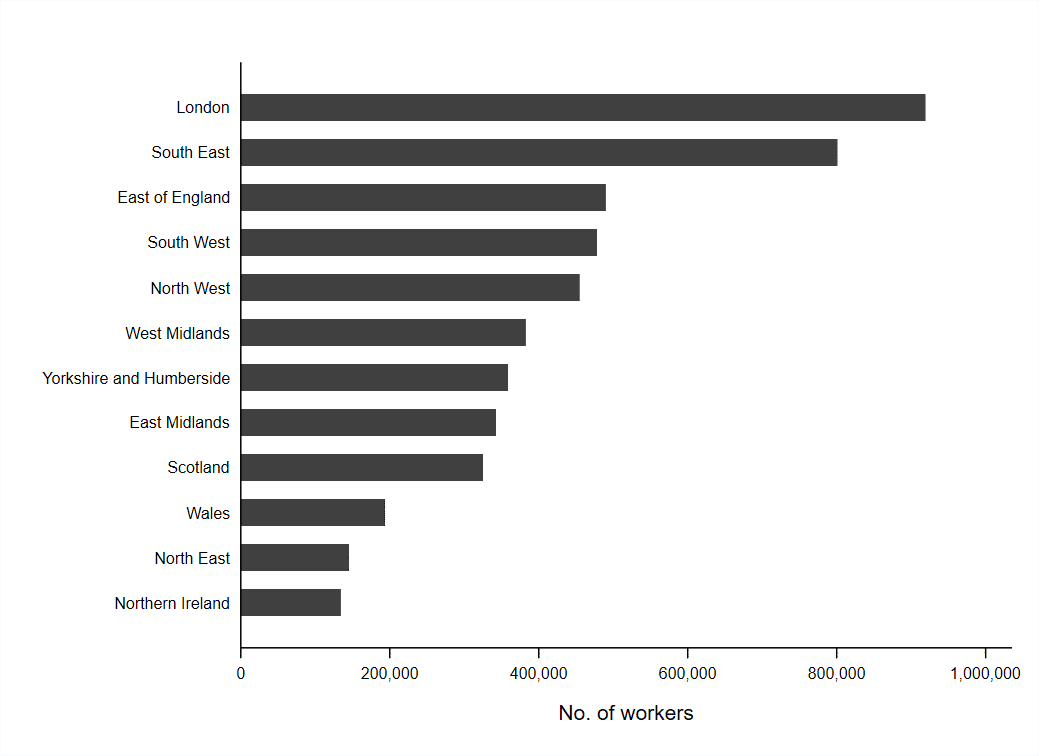

Scotland also has one of the lowest levels of self-employment among this same group (Figure 2). In both cases, we are not differentiating between the self-employed or those operating as an owner-managers of their own limited company.

Figure 2: Number of self-employed workers by UK region

Source: Labour Force Survey, October-December 2019

The outbreak of COVD-19 has and will continue to affect sectors of the economy quite differently. Self-employment also varies significantly across different parts of the economy, meaning the impact of pandemic, and the accompanying government measures, will vary.

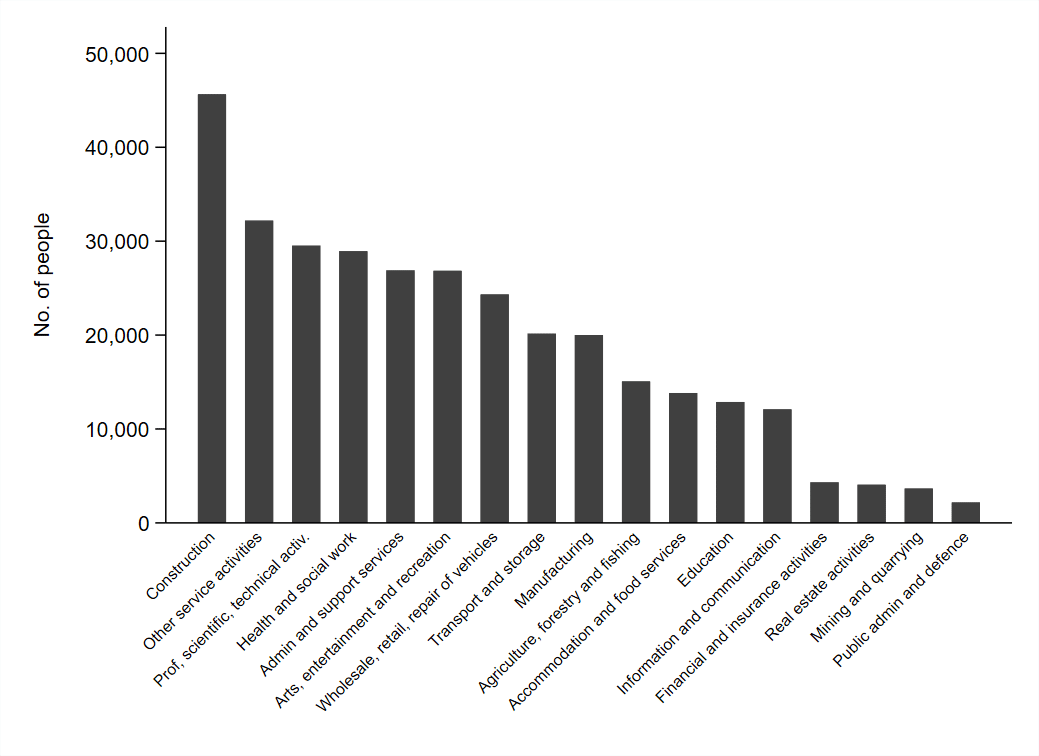

In terms of the number of people, by far the largest self-employed industry is construction (Figure 3). This is also an industry that will be affected greatly in coming months by site closures and drastic reduction in demand for non-essential work.

Figure 3: Number of self-employed workers by industry section

Source: Labour Force Survey, October-December 2019

The next largest sector – again, in terms of numbers of people – is other service activities, which covers a range of occupations, including hairdressers, beauty technicians, those who carry out repairs (of appliances, phones, computers, bikes etc ), independent writers, journalists and artists and pet care to name a few. These types of business have also been impacted greatly by social-isolation and distancing measures.

The professional scientific and technical activities industry also has a high number of people that are self-employed, and includes legal, consultancy, advertising/market research and architectural services.

Although we cannot tell with certainty, it might be reasonable to assume thse self-employed in this group are more likely to be owner-managers, even if just basing that guess on knowledge of the system (i.e accountants or management consultants might be more exposed to working within different business structures).

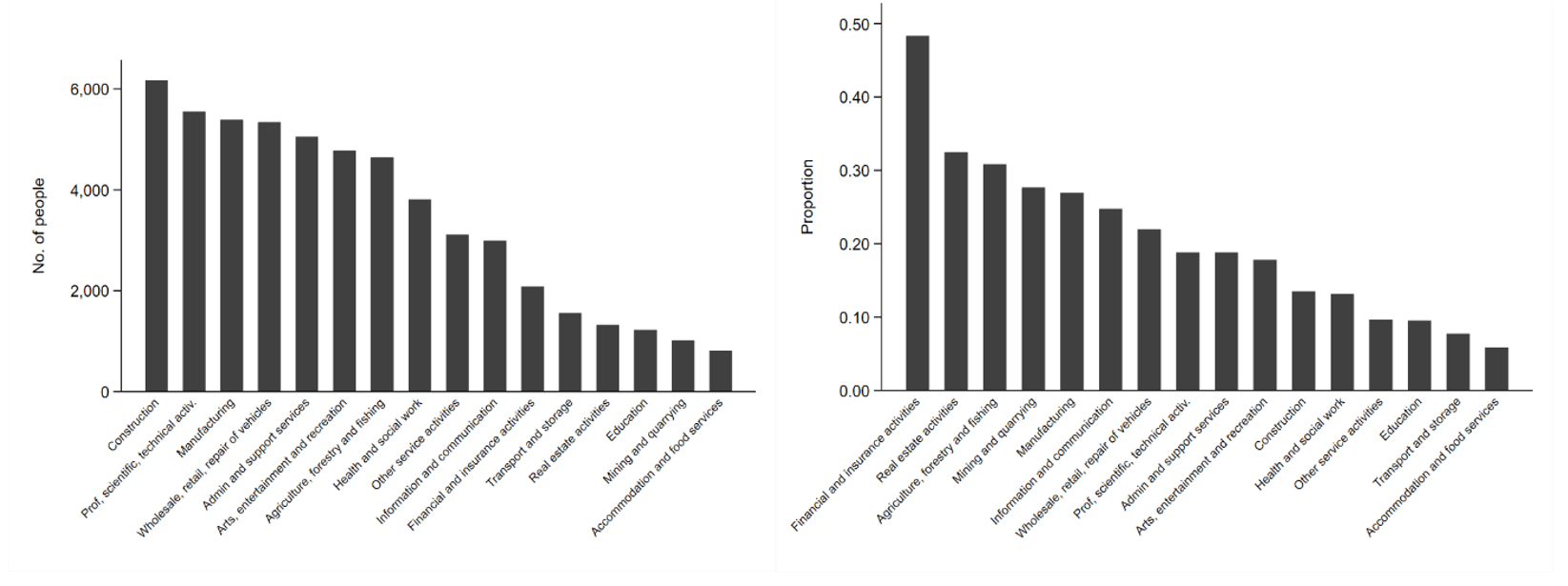

One way we can get at this question is to look at the number of people who report being an owner and sole director of a limited company as one of the reasons they are self-employed or don’t receive a salary directly from their employer.

Figure 4 shows that there isn’t a great deal of variation in the levels across industries (left panel). However, the proportion of self-employment within an industry that is due to individuals in this category is much lower for other services and construction than within professional scientific and technical activities. Financial and insurance activities have the largest proportion of their self-employed workforce reporting to be sole directors of a limited company by quite some way.

Figure 4: Number and proportion of workers self-employed workers operating as sole director of a limited corporation by industry section

Source: Labour Force Survey, October-December 2019

These numbers are of course imperfect, and can only act as a rough guide. Also, we still now very little about the number of people overall or within industries whose profit will exceed the £50,000 ceiling.

As a result, it is difficult to guess how the policy response will actually differ between them. However, we do know, for example, that wages for the employed tend to be much lower in the construction and other services sectors than in the professional, scientific and technical activities sector. This is, of course, not something on which to entirely base an estimate of the earnings or business status of the self-employed.

How it will work, and what to do in the meantime

The scheme will be implemented by HMRC, who will contact those eligible some time at the beginning of June. The Chancellor has said these people will be directed to fill out an online form, and, once they have completed the process, will quickly be paid a grant directly into their bank account.

One of the criteria for eligibility is that individuals must have “lost trading/partnership trading profits due to COVID-19”. It is not clear as of yet how this can be shown or, if/when it is, what the extent of support will be if it is dependent on the extent to which profits have fallen.

Given that the announcement made clear – and the government wants to incentivise – those who can to continue to work, this is a detail that will have to be made clear in weeks to come.

June is, however, just over 2 months away. Many who are self-employed and have been affected dramatically by the lockdown measures put in place to encourage social distancing and isolation will still need to get by between now and then.

Mr. Sunak has said that the current supports in place for the self-employed will still be accessible over this period. The removal of the minimum income floor on Universal Credit remains in place, as does access to contributory Employment Support or Jobseekers Allowances. There is also still the option or 3 month mortgage holidays and reduced rental rates, and Self-Assessment tax payments can be deferred until the end of January 2021.

Operational difficulties aside, this announcement is crucial for self-employed workers across the economy and will no-doubt help many a great deal. Of course, there are some who will not benefit from the scheme any might be left out once again. These are, as the Chancellor has made clear throughout, unprecedented times for our economy and labour market. The measures announced yesterday to support a crucial group may not be perfect, but they are a group for whom it can be difficult to identify earnings and risk of hardship. There may be yet more to come for those left out of this and the Coronavirus Retention Fund, but it cannot be underplayed how significant these investment in the UK’s workforce already are.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.