Today we published our latest Economic Commentary – our first commentary in partnership with Deloitte.

Alongside the usual commentary on the Scottish economy there are some interesting articles from:

- John Ireland and Mairi Spowage of the Scottish Fiscal Commission as they get ready for their first official forecasts in advance of the Scottish Budget;

- Sandy Stewart – Head of National Accounts in the Scottish Government – setting out the government’s plans to further develop economic statistics in Scotland;

- Neil Hamilton and Kenny Richmond from Scottish Enterprise looking at the recent performance of SMEs in Scotland;

- Stuart McIntyre from the FAI looking at developments in job-related training in Scotland; and,

- Paul Hopkins and Kenny Richmond (also from Scottish Enterprise) looking at the issue of late payment.

Here we summarise some of the key conclusions from our outlook section.

1. Our forecasts remain broadly the same as back in June – we continue to expect that growth will pick-up this year.

Our central numbers for 2017 and 2018 remain the same, although we have lifted our forecast slightly for 2019.

FAI forecast Scottish GVA growth (%) by sector 2017 to 2019

But in these uncertain times – particularly as the Brexit negotiations continue to take centre stage – we recommend that just as much attention is given to the range of estimates that underpin this outlook as well as to our central estimates.

FAI Scottish GVA forecast range 2017 to 2019

* Actual data to Q1 2017, central forecast with forecast uncertainty for 2017 – 2019. Uncertainty bands sourced from accuracy of past forecasts at different forecast horizons

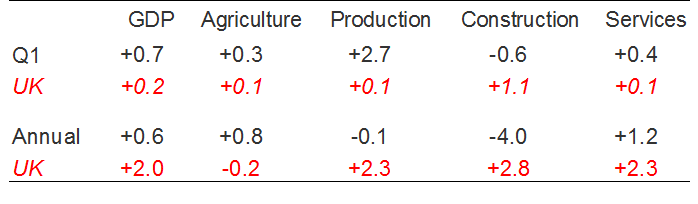

2. The Scottish economy returned to welcome growth in the first quarter of 2017, with quarterly growth of +0.7%: significantly faster than UK growth of +0.2%.

Scottish growth (%) by sector, Q1 2017

3. The upturn comes on the back of a challenging couple of years.

Scottish growth (since 2013) – year and quarter

Indeed revised estimates published after the Q1 statistics were first released, show that the Scottish economy actually contracted ever so slightly in 2016 – down 0.1% over the year (in part driven by the closure of Longannet power station).

4. Today’s Commentary also takes an in-depth look at the sources of the bounce back in Q1 2017. As we discussed here, much of the growth stemmed from three sectors which together account for just 6% of the Scottish economy.

And perhaps even more surprising, new analysis shows that virtually all the growth in Q1 2017 appears to have been driven by sales to the rest of the UK and the rest of the world. Domestic demand in Scotland was flat during the three months to March – with growth in household consumption and government spending offset by a fall in capital investment.

Drivers of growth Q1 2017 – weak domestic demand propped up by strong exports to the UK and ROW

The hope is that whatever the source of the bounce back, this will inject some momentum into the economy for the remainder of the year.

5. Of course, the statistics may be revised in the future. One area we look at in the Commentary is the Great Recession. Over the years there have been revisions to the impact of the financial crisis – with the downturn now much less severe than first thought.

The chart below shows the scale of the recession as estimated back in April 2012, then in April 2014 & April 2016, and finally today (Aug 2017).

Scotland during the Great Recession – perhaps not as great as first thought!

In 2012, the peak to trough decline in output (between 2008 and 2009) was estimated at 5.9%. Now the same recession is estimated to have been just 3.9% – about 1/3 less!

Statistical revisions are part-and-parcel of economic statistics. The Scottish Parliament has just started an inquiry into economic statistics in Scotland looking at potential areas of improvement, gaps and best practice.

6. The Scottish labour market continues to perform strongly with employment in Scotland at its highest ever rate since the Labour Force Survey was first started back in 1992.

Scottish employment & unemployment rate: 2008 to 2017

The increase in employment in the past year has been substantial, with employment rising by 44,000.

This has been driven, in part, by an increase in self-employment. While the self-employment series can be volatile, we are clearly seeing something of a trend. Indeed over the last 10 years, self-employment in Scotland is up 20%.

Scottish employment & self-employment: 2008 to 2017

But the high employment rate but weak economic growth has however, come at the expense of weak productivity data.

7. One set of strong results continues to be youth unemployment. Scotland’s rate of youth unemployment is at 9.4% for those aged 16-24 and 6.5% for 18-24 – one of the lowest in the UK and close to a record low (indicated by the black bar).

Youth unemployment across the UK – May-Jul 2017

8. The latest near-term indicators of economic performance continue to show growth – but that it remains fragile.

The FAI-Royal Bank of Scotland monitor for Q2 2017 – updated figures for Q3 to be published later this month – shows, for the second quarter in a row, an increase in the net balance of firms reporting both repeat business and new business volumes improving.

Scottish Business Monitor suggests business activity continuing to grow

In terms of sectors – both the FAI/RBS Business Monitor and the Scottish Chambers of Commerce Quarterly Economic Indicator – show that optimism in the tourism sector leads the way and this sits with wider reports of the sector having a strong 2017. Activity in construction appears to be picking up after a challenging few months. Growth elsewhere is solid if unspectacular. One weak spot continues to be in retail, where despite the official retail sales data showing growth in Q2, overall optimism remains weak.

But some pressures – primarily in recruitment and costs – are emerging.

9. In contrast, to business surveys, consumer confidence remains negative.

Confidence remains negative for Scottish consumers – and worse than for UK as a whole

Low levels of consumer confidence shouldn’t come as too much of a surprise given exceptionally weak earnings growth in the UK (and Scotland).

Falling UK regular average weekly earnings growth: 3-month on a year ago

10. Finally, in the Commentary we discuss the emerging policy context both in terms of Brexit and the debate about the future direction of the government’s Economic Strategy.

Some big decisions will be required in the coming months and these will likely dominate the upcoming Scottish Budget. Next week, we’re hosting our annual Scotland’s Budget presentation and will be publishing a report into the key opportunities, challenges and constraints facing the Finance Secretary as he prepares his budget for 2018/19. Full details will be provided on our website: www.strath.ac.uk/fraser

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.