Grant Allan, Stuart McIntyre, Graeme Roy, Fraser of Allander Institute, Department of Economics, University of Strathclyde

On Wednesday we will get the latest official data on GDP in Scotland. This will cover the period until the end of Q2 2016.

Once again, in advance of this publication, we offer our prediction of what that estimate might be, and crucially what it will tell us about the Scottish economy.

Recent Performance

The first – and most obvious – point to note is that Wednesday’s data will cover the period up to the end of June. We won’t have official data on how Scotland’s economy has fared since the EU referendum until January 2017.

As we outlined in our July Fraser Economic commentary, the Scottish economy has been facing some challenges in recent months and this week’s data comes on the back of some relatively weak data.

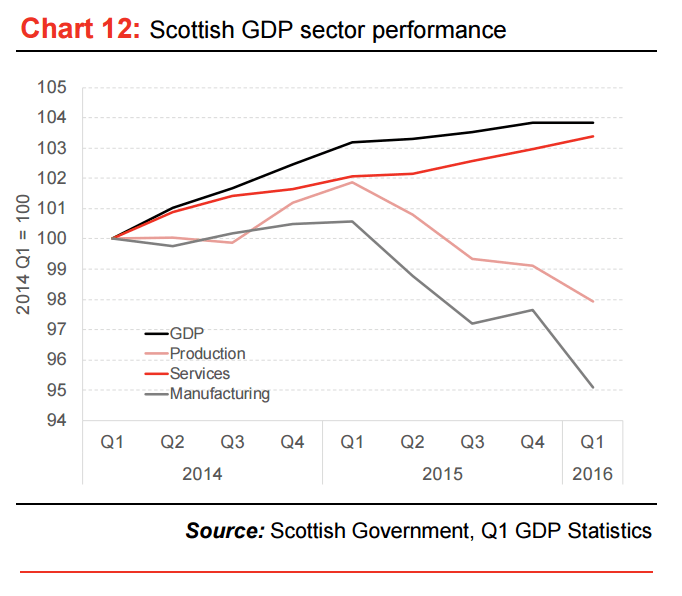

We’ve spoken at length about oil and gas sector, and its impact on the wider economy, as evident in the fall in manufacturing output in recent quarters:

But elsewhere there have been some wider challenges. Scottish exports in the year to June 2016 were 17.6% lower than they were in the year to June 2013.

On the other hand, the labour market data have looked better of late, with unemployment falling to 4.7% in the three months to July; lower than the UK rate of 4.9%. As we pointed out previously, unemployment is now lower than at any point since 2008 and that should be welcomed. However, we need to know where people exiting unemployment are going. As we highlighted last month, in the most recent period, the drop in unemployment appears to be driven by an increase in inactivity – i.e. those outside the labour market entirely.

If those exiting economic activity are doing so because of a scarcity of appropriate or accessible job opportunities, this is a cause for concern. Stephen Boyd of the STUC, writing on our blog, highlighted some additional concerns from the data, not least that women accounted for the entire rise in inactivity over the year.

What is our best estimate of this week’s figure?

Overall, the economic news in Q2 was not generally positive. For the first two months of the quarter, the Purchase Managers Index showed the economy actually contracting, and growing only slightly in the third month.

This was broadly consistent with the results contained in the Scottish Chambers of Commerce survey released on 14th July.

Our own Nowcasting work suggests that growth in Q2 was weak, and with the release of additional information through the summer, we saw our model revise down our estimate of economic growth in Scotland – leading to our recent estimates of around 0.3%.

In addition, as we have flagged up on a number of occasions, the Longannet power station closed at the end of March. This shut-down should have a significant impact on GDP in Q2 (we reckon it could take anything up to 0.4 percentage points off the headline growth rate).

The ‘Longannet effect’ won’t be immediately captured in our Nowcasting work, so taken together it’s our prediction that this week’s GDP figures will be relatively flat – and may even be negative depending upon how big the effect of Longannet is relative to the rest of the economy.

Of course, the economy may surprise on the upside, but we’ll need to see some careful explanation from the government statisticians about why this is the case.

What next?

Since the referendum, the economy has been largely in ‘wait-and-see’ mode – this is a positive. There was a risk that the immediate shock of the referendum outcome, coupled with a political vacuum within the UK Government, could have set off a chain reaction of uncertainty that damaged business and investment.

Last week we released the latest Scottish Business Monitor which we produce for Royal Bank of Scotland. Over the last three months, around 1/3 of firms reported an increase in business volume, whilst 1/3 saw a fall and 1/3 reported no change.

Overall, most forecasters have revised up their predictions for 2016 (since the immediate aftermath of Brexit) as the effects of uncertainty have failed to materialise. However, on the whole most remain pessimistic around 2017 – see chart below. The ‘x’ represents the average forecast. The top of the ‘box’ area represents the value of the upper quartile, and the lower edge of the box the value of the lower quartile. Points outside the ‘whisker’ are marked with dots, and are outliers. The forecasts are more varied for 2017 now compared to June 2016, and the range of forecasts has increased even for 2016, albeit at around the same average estimate for growth. Strikingly, the average forecast for UK growth in 2017 is now much lower than it was in June 2016.

On balance, we see no immediate need to revise our own forecasts just now, and we remain broadly in line with the UK average for 2017. Whilst we are lower in 2016, our weaker forecast for Scotland is driven by our expectations about the ongoing challenges in the North Sea continuing to resonate.

After a flat Q1 – and with the outlook increasing uncertain since the summer – Wednesday’s pre-referendum GDP figures for Scotland promise to provide a useful benchmark of the overall strength of the Scottish economy going into the second half of 2016.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.