While COVID-19 has had a significant impact on all sectors of the UK economy, some have been disproportionately affected by this health and economic crisis. In particular, tourism and hospitality suffered notable losses from the pandemic.

The COVID-19 pandemic led to an unprecedented simultaneous demand and supply shock to this part of the economy.

On the demand side, this was driven by travel bans, movement restrictions, curfews, and lost income.

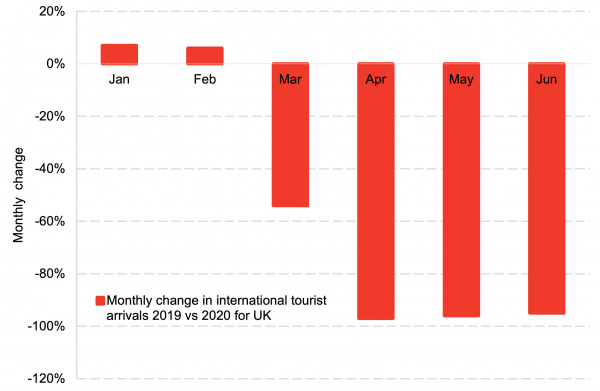

Chart 1 shows the latest available data for international tourist arrivals to the UK in 2020 relative to 2019. The data shows a substantial decline in international tourist arrivals from March 2020 onwards.

This coincides with the introduction of lockdown restrictions globally as well as the national lockdown across the UK that came into effect in late March. During this period international tourist arrivals fell to record low levels, reaching -97% in April 2020 relative to April 2019.

Chart 1: International Tourism Arrivals in the UK, 2020 relative to 2019

Source: UNWTO

On the supply side, many businesses across the tourism and hospitality sector have been forced to remain shut since the pandemic started. For instance, establishments selling food or drink were amongst the first to be closed to prevent the spread of COVID-19 and are expected to be some of the last to reopen completely.

Even when not forced to close completely, businesses in the sector had to follow strict social distancing guidelines, impacting their capacity limits and profitability.

In addition, tourism and hospitality businesses were often unable to adjust their operations to homeworking. This is unsurprising as accommodation and food Services, the largest subsector of tourism and hospitality, had the lowest share of workers that worked from home before the pandemic. As of 2019, only 10% of workers in this sector reported that they worked from home, compared to more than 50% in the information and communication sector. Chart 2.

Chart 2: Percentage of people that ever worked at home, UK, 2019

Source: ONS

As a result of these supply and demand side shocks, revenues in the Tourism and Hospitality sector have taken a hit. Revenue for international tourism in the UK was down 73% in quarter 3 of 2020, compared to the previous year. Chart 3.

Chart 3: International Tourism Revenues, UK, 2020 relative to 2019

Source: UNWTO

A BRIEF ASIDE

Work with us

We regularly work with governments, businesses and the third sector, providing commissioned research and economic advisory services.

Find out more about our economic consulting in Scotland.

The Scottish Hospitality Industry

So, how has the pandemic impacted the Scottish hospitality industry?

Since June 2020 the share of operating accommodation and food services businesses reporting lower turnovers than usual was consistently above 60% and peaked in August and November 2020 above 90%.

The latest available data, covering late January and early February 2021, indicates no sign of a trend reversal with more than 70% of businesses in the sector reporting lower turnover than usual.

Comparing this number to the current cross-industry average of 45% shows how the sector is disproportionately affected by the pandemic.

Chart 4: Share of Scottish businesses reporting lower turnovers, 15th June 2020 – 7th February 2021

Source: BICS Survey

This figure may well underestimate the true impact on sector turnover, as it only covers operating businesses. The latest data indicates that currently only around one-third of food service and accommodation businesses are operating, compared to a cross-industry average of 80%. This has a direct impact on employees: currently, 65% of the food services and accommodation workforce is on furlough and only 5% of the industry workforce is working from home. Table 1.

Table 1: BICS Survey results based on data from the 25th of January until the 7th of February, Scotland

The Regional Impact on the Scottish Tourism and Hospitality Sector

Previous commentaries showed that workers in the hospitality industry are younger, more likely to be female and earn particularly low wages. As a result, a shock to this sector threatens gender equality and income inequality more broadly.

To build on this analysis, one area we are focussing on in this commentary is the regional impact of this crisis to the hospitality sector.

Across Scotland, around 8% of businesses are in the hospitality sector. For some parts of the nation, such as the Highlands, North Ayrshire, and Argyll and Bute, this figure exceeds 10%. These areas are particularly reliant on tourism, making them more vulnerable to the economic impact of COVID-19.

Other parts of Scotland, such as Aberdeenshire have economies that rely much less on hospitality, making them more resilient to a shock in this area of the economy. Chart 5.

Chart 5: Share of Businesses in the Accommodation & Food Services industry, by region, 2020

Source: Scottish Government and ONS

Supply Chain and Demand Effects

Lastly, the crisis’ impact on hospitality also has important supply chain and demand implications.

Chart 6 plots the largest suppliers to the accommodation and food services sector. We find that wholesale/retail, agriculture, and construction supply the most to this sector. These sectors therefore would have suffered indirect losses from the shock to hospitality throughout this pandemic.

But this crisis is not limited to the supply side.

Chart 7 shows the top 10 sectors by that purchase goods and services from the accommodation and food services sector.

Insurance and pensions, Residential Care and Social Work, and Retail are the biggest buyers of services from this industry.

Chart 6: Biggest suppliers to Scottish Accommodation and Food Services Sector, 2017

Source: Scottish Government

Chart 7: Biggest sources of intermediate demand sectors from the Scottish Accommodation and Food Services Sector, 2017

Source: Scottish Government

The economic contribution of the accommodation and food services sectors to the Scottish economy

We have outlined what sectors supply to the hospitality sector in Scotland, and what sectors purchase from it. Therefore, it is evident that lockdown restrictions that have forced this sector to shut down would have had knock-on effects across the whole Scottish economy.

Although the national lockdowns have not resulted in complete shut downs of any industry, what would happen if the Scottish economy lost the hospitality sector?

Turning this question around, what is the economic value of the accommodation and food services sector to the Scottish economy?

In this section we model the economic contribution of the accommodation and food services sector to the Scottish economy.

This is carried out by hypothetically removing the accommodation and food services sector from the Scottish economy and estimating the size of the remaining economy – the difference between the original economy and the newly extracted economy is the contribution of the accommodation and food services sector to the Scottish economy.

The results highlight the direct, indirect and induced effects of the accommodation and food services sector. Figure 1.

Figure 1: Direct, indirect and induced impacts

Source: Fraser of Allander Institute

Table 2 highlights the direct, indirect and induced impact of removing the accommodation and food services sector from the Scottish economy.

Table 2: Economic impact of the Accommodation and Food Services industry

Source: FAI Calculations

The accommodation and food services industry contributes around £4.4bn in direct GVA to the Scottish economy.

However, when we add up the indirect and induced effects, the overall economic impact of the accommodation and food services sector to the Scottish economy increases to almost £7.6bn.

Across the Scottish economy the accommodation and food services sector supports 0ver 200,700 direct, indirect and induced jobs. This total includes direct employment of over 153,600 in the accommodation and food services sector but also, thanks to spill-over effects, employment in other parts of the Scottish economy.

Conclusions The hospitality sector has been asymmetrically impacted by the ongoing coronavirus pandemic and the subsequent national lockdowns and travel restrictions. A large share of the sector remains shut down and a significant number of its workforce are still furloughed. But, the impact of the closure of this sector is not limited to hospitality as its interconnectedness with other Scottish sectors means that there are spillover effects of shutting down this industry. Our modelling suggests that, once knock-on effects are accounted for, the accommodation and food services sector supports –

- Almost £7.6bn in Scottish GVA; and,

- Over 200,000 FTE employment in Scotland.

This sector is a major contributor to the Scottish economy and work will need to be done in the future to ensure that this industry, and the employees working within it, are supported in Scotland’s economic recovery from COVID-19.

Authors

The Fraser of Allander Institute (FAI) is a leading economy research institute based in the Department of Economics at the University of Strathclyde, Glasgow.